Financial experts commonly advise soon-to-be retirees to eliminate debt prior to leaving the labor force, as it is easier to draw funds from a steady paycheck. But what if you’ve already retired and are living in the red? Retirement and good living can seem like a far-fetched dream.

According to an analysis from finance website ValuePenguin, Americans age 65 and older carry an average $6,351in credit card debt.

“If you are retired, it’s generally too late to plan, but it’s certainly not too late to take action,” says Hugh McDonald, a certified senior advisor and president of HJM Financial Group in Sun City, California.

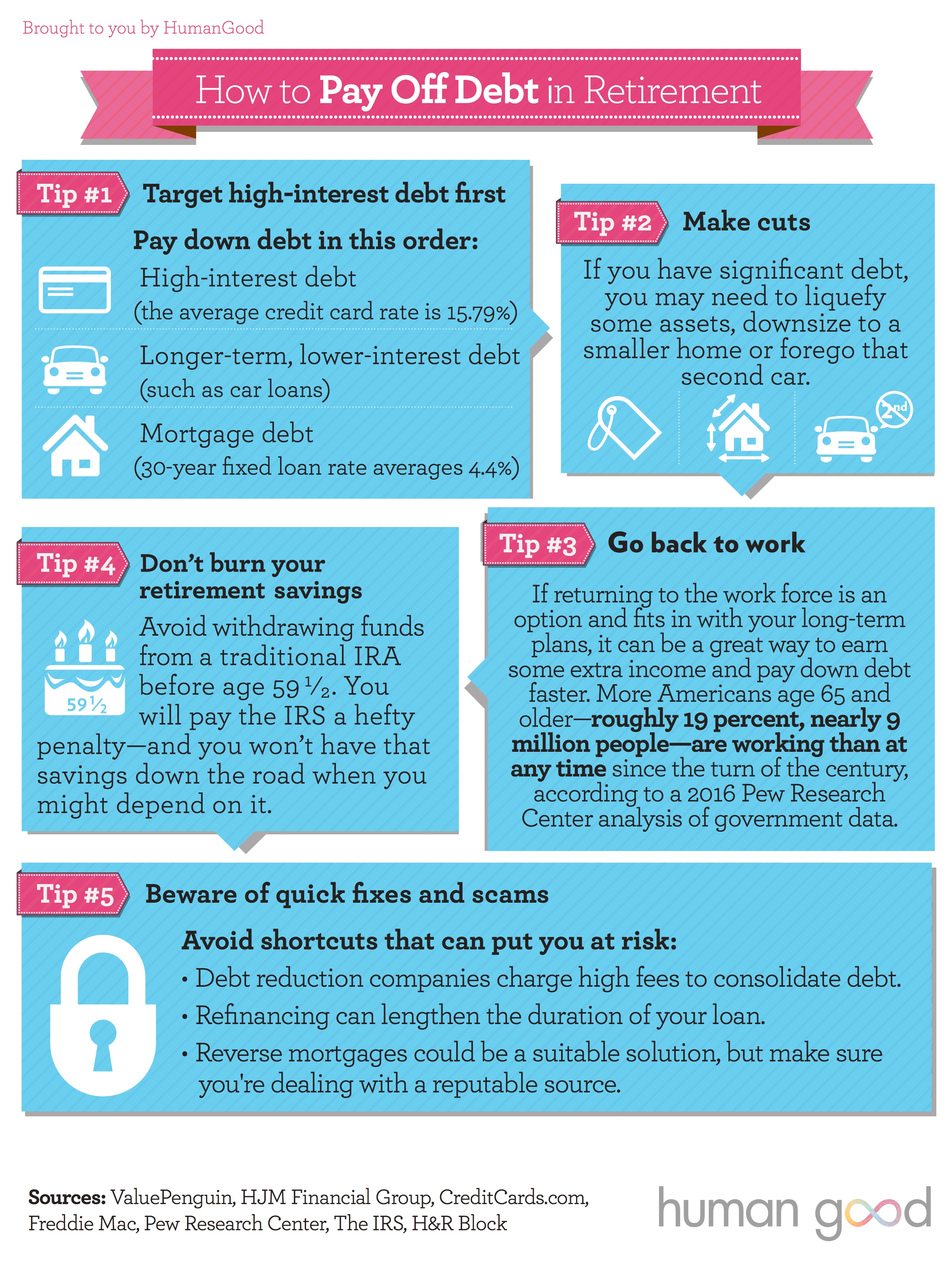

For assistance creating a plan to pay down retirement debt, print this infographic and use the tips provided in it as you work through your financial situation.

71da.png?width=260&height=56&name=new-hg-logo-rev-with-registered-mark%20(2).png)